Unused Vacation Liability Compromises Cash Flow and Creditworthiness![]()

You have seen the lingering liability of unused vacation time on your company’s balance sheet. And you are likely aware that the problem is not unique to your company or to your employees. But how serious and prevalent is the problem? Since the late 1990s, there has been a measurable, steady decline in vacation usage. Oxford Economics, in conjunction with the Bureau of Labor Statistics, found that Americans took on average one week less vacation in 2016 than they did in 1996. This reduction in vacation usage has proven problematic for employers. An online survey by Gfk found that US companies had about $272 billion in vacation liability sitting on their collective balance sheets in 2016. This number was up 21 percent since 2015. ADP, a global payroll and HR solutions company, was adding $50 million a year to its liabilities due to unused vacation time.

If you support a smaller company that is still in growth mode or seeking outside investments, then you are particularly impacted by unused vacation liability. When money is shown on your company’s balance sheets as a liability, it cannot be allocated towards investments like improvements and new assets to help the business grow and perform better financially. It also makes the company appear less favorable in the event of a merger or acquisition.

Popular “Solutions” Fail to Solve the Real Problem

Historically, most companies have not effectively addressed the issue of vacation liability.

Paying It Out

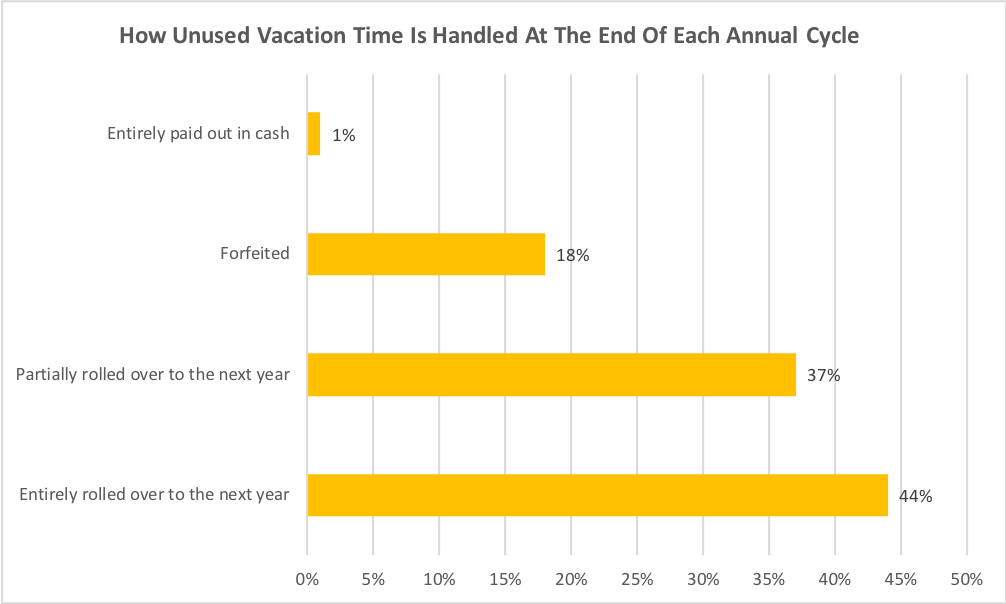

Paying out any unused vacation gets the liability off the books, but it does not solve the many hidden costs of unused vacation. When employees have the option to receive cash in lieu of paid time off, it incentivizes them not to take vacations. This can have health, safety and productivity implications. World at Work’s 2014 survey on vacation practices (see Figure 1) revealed that relatively few companies go this route.

Forfeiting

Adopting a “use it or lose it” policy where employees forfeit any unused vacation at the end of the year resets the vacation liability to zero for the next year but does nothing to address the liability in the current year. Companies may adopt this type of policy in hopes that employees will be compelled to use their vacation time. This strategy often results in too many people requesting time off at the end of the year, which can create conflict with workloads and deadlines. There are even a few states in which “use it or lose it” policies are unlawful because vacation pay is considered to be deferred wages to which employees are entitled. The survey found this to be the second least utilized method.

Rolling it Over

The most popular method, according to the survey, is allowing some or all unused vacation to carry over to the next calendar year. This only prolongs the liability. Employees may also build up vacation time to use in the event of a layoff, job elimination or reduction in force, effectively using their vacation bank as a savings account. Employees are more likely to experience burnout, and employers are exposed to the related risks.

No Balance

An emerging practice that has received much media attention in recent years is the use of “unlimited” or “self-managed” vacation where employees have no official balance and no vacation accrual. While this policy does keep vacation liabilities off the balance sheet, employees may react poorly to the news of such a policy. Tribune Publishing, for example, had to rescind their new unlimited time off policy after only 8 days due to negative employee feedback. Unlimited PTO also does not encourage employees to take vacations. According to research conducted by SHRM, only 1% of employers offered unlimited paid time off in 2017.

Who Really Benefits From This Accounting Strategy?

Unlimited vacation has been touted as an amazing perk to attract talent and promote accountability with a “work hard, play hard” philosophy. You may have even considered it for your organization.

Unlimited vacation has been touted as an amazing perk to attract talent and promote accountability with a “work hard, play hard” philosophy. You may have even considered it for your organization.

Despite the hype, unlimited vacation has not proven to be more beneficial to employees. Several companies, including Kickstarter that implemented unlimited vacation policies, found that their employees took about the same amount of vacation as they did before the switch. Observations and informal surveys from HR professionals like Bruce Elliot, SHRM’s Manager of Compensation and Benefits, confirm that even when employees have the option to take as much time as they want, they don’t.

There are, however, several ways in which companies benefit from such policies. And these advantages might tempt you to try this insufficient strategy. With an unlimited vacation policy, the need for your company to track and account for vacation usage is greatly reduced or eliminated. This lowers costs associated with administrative time spent on vacation tracking. You do not have to account for it financially because there is no way to account for something unlimited. Under an unlimited vacation policy, your company avoids having to pay out any unused vacation time when an employee leaves the organization.

Since how much time off an employee gets to take under an unlimited vacation policy is unclear, many employees may shy away from taking time off out of fear that expectations might not be met. Employees also are only able to take time off that is approved by the company. The combination of employees being hesitant to request time off and employers failing to approve it when requested might eventually result in less vacation being used under an unlimited policy.

Unlimited policies work especially against employees at companies’ that chiefly employ billable professionals (e.g. Attorney’s, CPAs, Engineers). These companies’ business models prevent employees from taking time off away from work, fully “unplugged.” Since their employees have to answer phone calls and emails and even attend meetings while on vacation, it is easy to make their vacations “unlimited”.

What are Some Forward-Thinking Companies Already Doing?

Vacation Incentives

Forward-thinking companies get that it’s in everyone’s best interest to encourage employees to take vacations. Real vacations. And these companies offer additional perks to incentivize the practice. FullContact, a cloud-based contact-management software company, offers their employees a $7,500 vacation bonus. In order to receive the bonus, employees must disconnect completely from work. If they do any work at all, including checking emails, while on vacation, they do not get the money. Software company MOZ reimburses their employees up to $3,000 a year for their vacations. Marriott International offers hotel and vacation package discounts to its employees. Many other companies have similar vacation enhancing perks that are designed to address the underlying problem of people not taking vacations.

Mandatory Vacation

According to Ernst & Young, a risk assurance and financial consulting firm, the employees most likely to commit fraud are tenured employees with a long history of not taking their annual leave. They recommend that employers require employees to take at least 2 consecutive weeks of vacation each year. Anthology, a recruiting platform, introduced a mandatory vacation policy to reduce the risks associate with employee burnout. Several other companies have implemented mandatory vacation policies to get their US employees to take their vacations. Balsamiq, a company that aids with software design, used to have an “unlimited” vacation policy, but it didn’t work. Employees were not taking enough vacation time. To get employees to take time off, the company implemented a policy that employees must take at least 20 days off work each year. At Authentic Jobs, employees are required to take 12 holidays and 15 vacation days each year. And BareMetrics, a SAAS analytics company, has a minimum vacation policy that requires employees to take at least 4 weeks off with a least one week-or-longer vacation.

Vacation Deprivation Comes With Hidden Costs

While unlimited vacation gets vacation liability off your balance sheet, there are far greater costs resulting from unused vacation. Heavy workloads that result in burnout could be reduced by the productivity gains from employees taking vacations. According to the Harvard Business Review, 94% of vacations result in a positive ROI for employees’ energy and outlook. Project Time Off cites that 89% of managers agree that employees who use their vacation time use fewer sick days and are less likely to burn out. In the Huffington Post’s article on the costs of turnover, they cite evidence that losing and replacing an employee can cost anywhere from 16-213% of the employee’s annual salary. Since managers and executives are statistically the least likely to take a vacation and may be more likely to burn out, the vacation-related turnover costs can be extremely high.

It’s Time to do What Works

When it comes to addressing the costs of unused vacation time, companies that enforce vacation limits and balance adherence miss the mark. Success occurs through a culture of required and incentivized vacations. By shifting the focus of vacation policies from restrictions to results, you can best reduce or eliminate your company’s unused vacation liability.

Start Reducing Your Costs Now

Implement mandatory and/or incentivized vacation policies and reduce costs associated with:

- Employee Fraud

- Health and Safety Issues

- High Employee Turnover

- Decreased Productivity

Get Vacation Liability Off Your Books

Improve your organization’s financial profile by clearing unused vacation liability from your balance sheets.

Be a Part of the Solution

By participating in our brief survey, you can be a part of the solution.